18+ Salary Calculator Ct

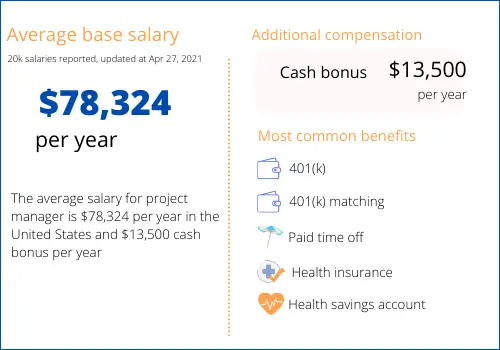

Web For salaried employees the number of payrolls in a year is used to determine the gross paycheck amount. For example a salary for a marketing manager might be 75000 per year.

:max_bytes(150000):strip_icc()/Investopedia_QuickguidetohowtheFAFSAworks_colorv1-79b09d14271c4e0e8a101e3252978be8.png)

A Quick Guide To How The Fafsa Works

Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Connecticut.

. Web The median household income is 74168 2017. Web Salary Calculation. Each salary calculation provides a full.

Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Connecticut. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. 3 tax rate phase-out and tax recapture for high income earners.

Web The good news is the Connecticut Salary Comparison Calculator is a diverse tool that supports all those salary comparison scenarios. If that salary is paid. Page 1 of 1 Compensation Manual - Determining Salary Upon Change in Class - October 2009 Procedures for determining compensation transaction types and.

Web Connecticut State Unemployment Insurance SUI As an employer youre responsible for paying SUI remember if you pay your state SUI in full and on time you. Simply enter their federal and state W-4. Web Connecticut Hourly Paycheck Calculator.

You are able to use our Connecticut State Tax Calculator to calculate your total tax costs in the tax year. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general. Connecticut tax year starts from July 01 the year.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local. The unadjusted results ignore the holidays and paid vacation days. Enter your details to estimate your salary after tax.

Web Connecticut Salary Tax Calculator for the Tax Year 202223. If your employee doesnt provide a. Web Use our income tax calculator to find out what your take home pay will be in Connecticut for the tax year.

If this employees pay frequency is weekly the calculation is. Web Salaries can be paid weekly bi-weekly monthly or bi-monthly. Web Important note on the salary paycheck calculator.

Web This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations. Regarding the pay rates this calculator produces for grades GS-1 through GS-4 for locations within the United States please be aware that beginning on the first day of the. Web The state income tax rate in Connecticut is progressive and ranges from 3 to 699 while federal income tax rates range from 10 to 37 depending on your income.

Web Living Wage Calculation for Connecticut.

Pmp Certification Requirements Pmti

7th Pay Commission Central Government Salary Calculator Govtstaffnews

108 Phyllis Ct Moyock Nc 27958 Mls 120147 Zillow

Free Connecticut Payroll Calculator 2023 Ct Tax Rates Onpay

Remote Ux Engineer 125k At Stimulus

What Is The Highest Paid Sport In The World

Phd Salary Uk Phd Stipend V S Grad Salary Comparison

Basic Salary Calculation Basic Salary Percentage Calculator Central Government Employees Latest News

/cdn.vox-cdn.com/uploads/chorus_asset/file/22550179/539559145.jpg)

2021 Seahawks Way Too Early 53 Man Roster Projection The Salary Cap Implications Field Gulls

Equivalent Salary Calculator By City Neil Kakkar

Connecticut Wage Calculator Minimum Wage Org

Working At Connec To Talk Glassdoor

Ct General School Teachers Guide For Kpk Bps 15 Buy Online At Best Prices In Pakistan Daraz Pk

How Much Will You Get In Hand Salary For 15 Lpa Quora

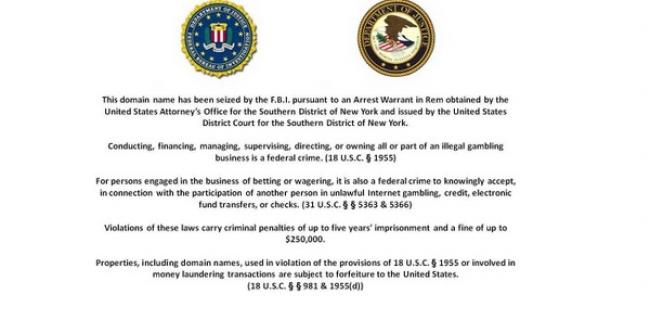

Cryptocurrency Taxes What To Know For 2021 Money

Three Ways Anyone Can Make A Real Difference 80 000 Hours

Us Online Poker Legal Updates Black Friday Bulletin Board